BROWSE BY CITY

MLS Listings

Be the first to discover latest properties in Calgary. Our website is updated from mls listings in calgary and surrounding every 15 mins.

VIEW NEW LISTINGS

Sell My Home

Get an instant estimate of your property's current market value. We will help you market your property and define all timelines so you are in the loop.

SHOW ME HOW

Resources

become a savvy home buyer/investor/seller. Our blog is packed with resources such as mortgage calculators,

CLICK HERE

Safest Calgary Neighborhoods for Families 2025

Most Affordable Calgary Neighborhoods 2025

MLI SELECT

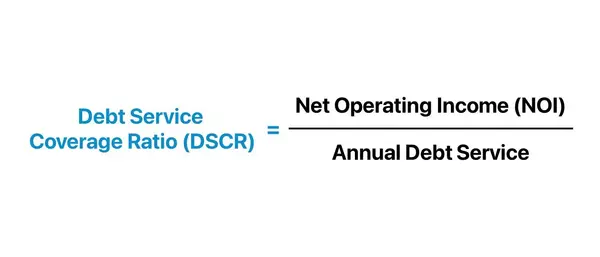

- Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

- How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide)

- Navigating the CMHC MLI Select Program: A Step-by-Step Guide for Investors (2025)

eXp Realty

Discover a place you'll love to live

FIRST TIME HOME BUYER

"Once In A Life Time Oppurtunity"

MORTGAGE CALCULATOR

Mortgage values are calculated by Lofty and are for illustration purposes only, accuracy is not guaranteed.