SK Government Grants & Rebates

How to Get a FREE Smart Thermostat: Your Guide to SaskPower's Energy Assistance Program

How to Get a FREE Smart Thermostat: Your Guide to SaskPower's Energy Assistance Program Are you a Saskatchewan homeowner looking to save money on your energy bills? Here's some exciting news: SaskPower's Energy Assistance Program is offering FREE smart thermostats to eligible households! As your loc

Read More

How to Use the First Home Savings Account (FHSA) to Buy Your First Home

The Ultimate Guide to Canada’s First Home Savings Account (FHSA) Start Saving for Your First Home Today with Canada’s FHSA Buying your first home is an exciting milestone, but the financial hurdles can feel overwhelming. That’s where Canada’s First Home Savings Account (FHSA) comes in—a groundbreak

Read More

TFSA vs. FHSA: Which is Better for First-Time Homebuyers?

TFSA vs. FHSA: Which is Better for First-Time Homebuyers? When it comes to saving for your first home in Canada, two powerful tools stand out: the Tax-Free Savings Account (TFSA) and the First Home Savings Account (FHSA). Both offer significant tax benefits and can accelerate your journey to homeown

Read More

Easy Canadian Home Buyer’s Guide (Focused on Alberta & Saskatchewan) – Steps, Programs & Tips

First-Time Home Buyer’s Guide to Alberta & Saskatchewan Buying your first home is a big deal—especially in provinces like Alberta and Saskatchewan, where you’ll find a balance of affordability, government programs, and diverse housing options. Below is a step-by-step look at how the home-buying proc

Read More

Home Renovation Tax Credit (SK)

Allows Saskatchewan homeowners to save up to $2,100 in provincial income tax by claiming a 10.5% tax credit on up to $20,000 of eligible home renovation expenses. Applies to Saskatchewan Residents only. Learn More Under this non-refundable tax credit, Saskatchewan homeowners may save up to $2,100

Read More

Secondary Suite Incentive Program (SK)

The grant program will provide 35 per cent of the total price to construct a new secondary suite at an owner’s primary residence, to a maximum of $35,000 for a qualifying suite. Applies to Saskatchewan residents only. learn more. The Saskatchewan Secondary Suite Incentive (SSI) grant program is de

Read More

More Reading

- Things to do in Saskatoon this summer June 2025 Edition

Saskatoon in Full Swing: Your Ultimate Guide to June 2025 Events! June 2025 is bursting with energy in Saskatoon! If you're looking for exciting things to do, you've come to the right place. To help you make the most of this vibrant month, we’ve curated a guide to some of the best festivals, concert

Saskatoon in Full Swing: Your Ultimate Guide to June 2025 Events! June 2025 is bursting with energy in Saskatoon! If you're looking for exciting things to do, you've come to the right place. To help you make the most of this vibrant month, we’ve curated a guide to some of the best festivals, concert - How to Get a FREE Smart Thermostat: Your Guide to SaskPower's Energy Assistance Program

How to Get a FREE Smart Thermostat: Your Guide to SaskPower's Energy Assistance Program Are you a Saskatchewan homeowner looking to save money on your energy bills? Here's some exciting news: SaskPower's Energy Assistance Program is offering FREE smart thermostats to eligible households! As your loc

How to Get a FREE Smart Thermostat: Your Guide to SaskPower's Energy Assistance Program Are you a Saskatchewan homeowner looking to save money on your energy bills? Here's some exciting news: SaskPower's Energy Assistance Program is offering FREE smart thermostats to eligible households! As your loc - Calgary Real Estate Market Segments: What's Hot, What's Not (Jan 28, 2025)

- Calgary Real Estate: Strategic Seller Guide (Jan 28, 2025)

- Calgary Housing Market Update 2025 (Jan 28, 2025)

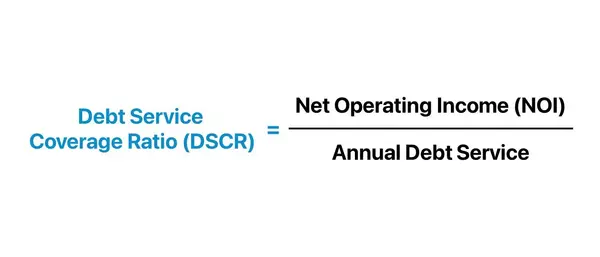

- Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

- How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide)

How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide) Investing in multi-million dollar properties with just 5% down is no longer a pipe dream—thanks to Canada's CMHC MLI Select Program. Designed for investors eyeing large multi-unit residential buildings,

How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide) Investing in multi-million dollar properties with just 5% down is no longer a pipe dream—thanks to Canada's CMHC MLI Select Program. Designed for investors eyeing large multi-unit residential buildings,