Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

Navigating the world of multi-unit residential financing can be daunting, especially when dealing with the CMHC MLI Select program. To make informed decisions and maximize your investment returns, it's crucial to understand the key terms and concepts that lenders and mortgage insurers use to evaluate your application. In this article, we'll break down the most important metrics, including debt service coverage ratio (DSCR), loan-to-value ratio (LTV), net operating income (NOI), and capitalization rate.

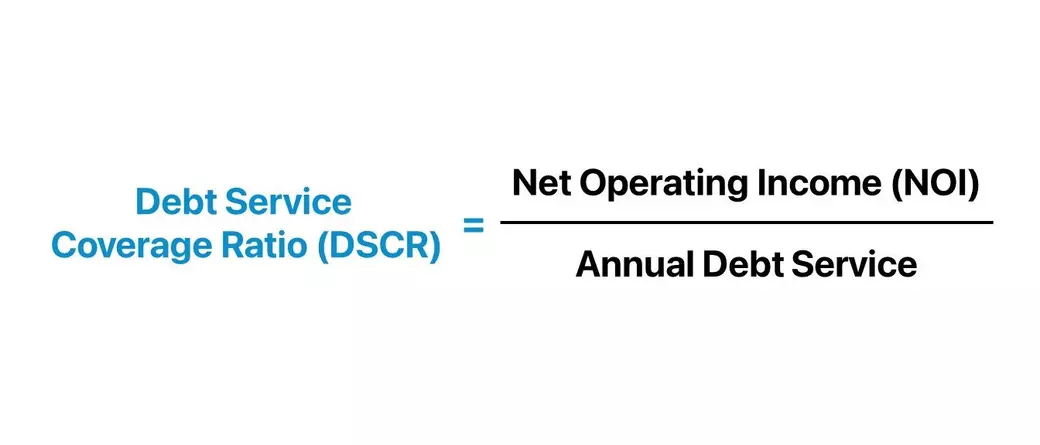

1. Debt Service Coverage Ratio (DSCR)

DSCR is a measure of a property's ability to generate enough income to cover its mortgage payments and operating expenses. It is calculated by dividing the property's annual net operating income by its annual debt service (mortgage payments). For the MLI Select program, CMHC requires a minimum DSCR of 1.10, meaning the property must generate at least 10% more income than its expenses.

Formula:

DSCR = Annual Net Operating Income / Annual Debt Service

Example:

- Annual Net Operating Income: $150,000

- Annual Debt Service: $120,000

- DSCR = $150,000 / $120,000 = 1.25

2. Loan-to-Value Ratio (LTV)

LTV is the ratio of the mortgage loan amount to the property's value. It represents the percentage of the property's value that is financed by the mortgage. For MLI Select, CMHC allows up to 95% LTV for qualified borrowers, meaning you can finance up to 95% of the property's value with a mortgage and put as little as 5% down.

Formula:

LTV = Mortgage Loan Amount / Property Value

Example:

- Mortgage Loan Amount: $950,000

- Property Value: $1,000,000

- LTV = $950,000 / $1,000,000 = 0.95 or 95%

3. Net Operating Income (NOI)

NOI is a property's annual income after operating expenses but before debt service and taxes. It is a key metric for evaluating a property's financial performance and cash flow potential. To calculate NOI, subtract all operating expenses (such as property taxes, insurance, utilities, repairs, and management fees) from the property's gross income.

Formula:

NOI = Gross Income - Operating Expenses

Example:

- Gross Income: $200,000

- Operating Expenses: $50,000

- NOI = $200,000 - $50,000 = $150,000

4. Capitalization Rate (Cap Rate)

Cap rate is a measure of a property's investment return, expressed as a percentage of its purchase price or market value. It is calculated by dividing the property's annual net operating income by its purchase price or market value. Cap rates are used to compare properties and evaluate their relative investment potential.

Formula:

Cap Rate = Annual Net Operating Income / Purchase Price or Market Value

Example:

- Annual Net Operating Income: $150,000

- Purchase Price: $2,000,000

- Cap Rate = $150,000 / $2,000,000 = 0.075 or 7.5%

Other Important Terms

- Mortgage Stress Test: A test that evaluates a borrower's ability to make mortgage payments at a higher qualifying interest rate, typically the greater of the contract rate plus 2% or 5.25%.

- Amortization Period: The length of time over which a mortgage is paid off, usually 25-35 years for residential properties.

- Mortgage Insurance Premium: A fee paid to CMHC for insuring the mortgage, calculated as a percentage of the loan amount and included in the mortgage payments.

Frequently Asked Questions (FAQ)

1. What is a good DSCR for a rental property?

A DSCR of 1.25 or higher is generally considered good, as it indicates the property generates sufficient income to cover its expenses with a comfortable margin.

2. How does LTV affect my mortgage interest rate?

A lower LTV typically results in a lower interest rate, as it represents less risk to the lender. Conversely, a higher LTV may lead to higher interest rates or additional mortgage insurance requirements.

3. What expenses are included in calculating NOI?

Operating expenses include property taxes, insurance, utilities, repairs, maintenance, and management fees. However, mortgage payments and income taxes are not included in NOI calculations.

4. How do I find the cap rate for a property?

You can calculate the cap rate by dividing the property's annual net operating income (NOI) by its purchase price or market value. Alternatively, you can research comparable properties in the area to estimate the cap rate.

Glossary of Terms

- Debt Service Coverage Ratio (DSCR): A measure of a property's ability to cover its debt obligations with its income.

- Loan-to-Value Ratio (LTV): The ratio of the mortgage loan amount to the property's value.

- Net Operating Income (NOI): A property's annual income after operating expenses but before debt service and taxes.

- Capitalization Rate (Cap Rate): A measure of a property's investment return, expressed as a percentage of its purchase price or market value.

- Mortgage Stress Test: A test to evaluate a borrower's ability to make mortgage payments at a higher interest rate.

- Amortization Period: The length of time over which a mortgage is paid off.

- Mortgage Insurance Premium: A fee paid to CMHC for insuring the mortgage.

Future Enhancements

To make this article even more comprehensive, we plan to include the following elements in future updates:

- Visual Aids: Charts, graphs, or infographics to help visualize the concepts and make the information more engaging.

- Real-World Case Studies: Practical examples demonstrating how these metrics are applied in multi-unit residential investments.

- Contextual Internal Links: Links to related content on our website, such as detailed guides on the CMHC MLI Select program, mortgage application tips, and investment property strategies.

To learn how to buy multi-million dollar properties with just 5% down, read our article: How to Buy Multi-Million Dollar Properties with 5% Down.

For a deeper dive into the CMHC MLI Select program, check out our detailed guide: CMHC MLI Select Program: Everything You Need to Know.

Complete a buyer intake form today: CMHC MLI Select Buyer Intake Form

Categories

- All Blogs (694)

- AB Gov Grants & Rebates (6)

- airbnb-vs-long-term-rentals-calgary-guide (2)

- buyer resources (2)

- Calgary Real Estate (14)

- Edmonton Real Estate (6)

- First Time Home Buyer (11)

- Investment Tips (11)

- market update (7)

- Monthly Market Report (1)

- Mortgage Tips n Tricks (4)

- North East Calgary (1)

- North West Calgary (1)

- Property Management (3)

- Real Estate Trends and Insights (5)

- Saskatoon Events (1)

- saskatoon real estate (1)

- seller resources (2)

- SK Gov Grants & Rebates (10)

- Solution (4)

- Things To Do In Saskatoon (1)

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "