Calgary Real Estate Tips for Buyers & Investors (2025)

Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

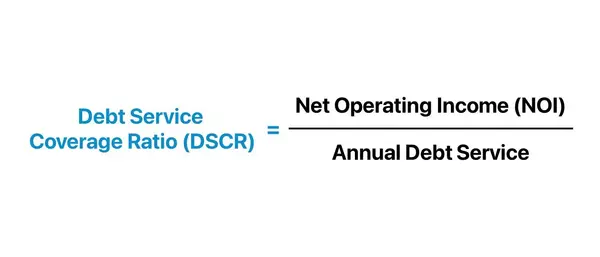

Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

Navigating the world of multi-unit residential financing can be daunting, especially when dealing with the CMHC MLI Select program. To make informed decisions and maximize your investment returns, it's crucial to understand the

TFSA vs. FHSA: Which is Better for First-Time Homebuyers?

TFSA vs. FHSA: Which is Better for First-Time Homebuyers?

When it comes to saving for your first home in Canada, two powerful tools stand out: the Tax-Free Savings Account (TFSA) and the First Home Savings Account (FHSA). Both offer significant tax benefits and can accelerate your journey to homeown

Mortgage Rules Update: Insured Cap Raised to $1.5M & 30-Year Amortizations for First-Time Buyers

Mortgage Rules Update: Effective December 15 – Insured Cap Raised to $1.5 Million & 30-Year Amortizations Now Available

Effective December 15, recent mortgage reforms are changing the landscape for Canadian homebuyers. Whether you’re just stepping into the market or looking to upgrade, these policy

Fixed vs. Variable Mortgage Rates: What's Best for You?

Fixed vs. Variable Mortgage Rates: What's Best for You?As a first-time home buyer in Saskatoon or an experienced homeowner looking for houses for sale in Saskatoon, understanding mortgage rates is crucial to making an informed decision. One of the most important choices you'll face when securing a m

Hasan Sharif

Phone:+1(403) 808-9705