Calgary Real Estate Tips for Buyers & Investors (2025)

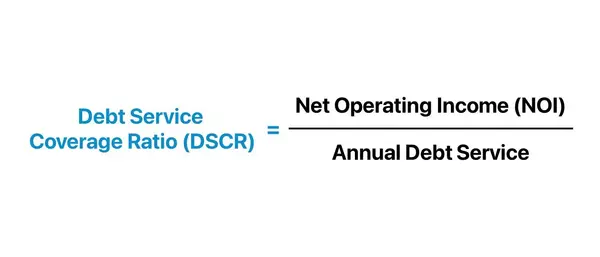

Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

Navigating the world of multi-unit residential financing can be daunting, especially when dealing with the CMHC MLI Select program. To make informed decisions and maximize your investment returns, it's crucial to understand the

How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide)

How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide)

Investing in multi-million dollar properties with just 5% down is no longer a pipe dream—thanks to Canada's CMHC MLI Select Program. Designed for investors eyeing large multi-unit residential buildings,

Navigating the CMHC MLI Select Program: A Step-by-Step Guide for Investors (2025)

Navigating the CMHC MLI Select Program: A Step-by-Step Guide for Investors (2025)

Quick Navigation:

Program Overview

Key Advantages

Eligibility Requirements

Points System Explained

Contact Getty Group:

📱 Instagram: @nasahctus📧 Email: hasan@gettygroup.ca📞 Phone: 403-808-9705

Complete a buyer i

What does Bank of Canada's Rate Cuts mean for your Mortgage?

Breaking Down Bank of Canada's Rate Cuts: What It Means for Your Mortgage

Hold onto your wallets, Canadian homeowners and mortgage hunters! The Bank of Canada is making moves that could change your financial landscape. With rate cuts on the horizon and the mortgage market in flux, understanding thes

Edmonton: Your Ticket to a Life-Changing Fresh Start

Published on March 23, 2025 at 02:19 PM CST

Edmonton: Your Ticket to a Life-Changing Fresh Start

Imagine a city where your dreams don't just survive—they thrive. Welcome to Edmonton, Canada's hidden gem that's about to turn your life's trajectory upside down (in the best possible way)!

Table of Cont

Market Crash or Opportunity? The Insider's Guide to Surviving Economic Uncertainty

Market Crash or Opportunity? The Insider's Guide to Surviving Economic Uncertainty

BREAKING: Is the stock market heading for a complete meltdown? Before you panic-sell your investments, read this strategic breakdown that could save your financial future—and potentially make you money!

Market Volatil

Hasan Sharif

Phone:+1(403) 808-9705