Calgary Real Estate Tips for Buyers & Investors (2025)

Calgary Real Estate Market Segments: What's Hot, What's Not (Jan 28, 2025)

Calgary Real Estate Market Segments: What's Hot, What's Not (Jan 28, 2025)

Key Market Update

Interest rate announcement tomorrow (Jan 29, 2025)! Follow @nasahctus for live segment-by-segment impact analysis.

Current Segment Performance

Detached Homes (Market Leader)

85% of inventory above $600

Calgary Real Estate: Strategic Seller Guide (Jan 28, 2025)

Calgary Real Estate: Strategic Seller Guide (Jan 28, 2025)

Breaking Market News

Interest rate update coming tomorrow (Jan 29, 2025)! Follow me on Instagram @nasahctus for live updates and market impact analysis.

Critical Market Stats

Detached home median prices up 4.5% year-over-year

85% of de

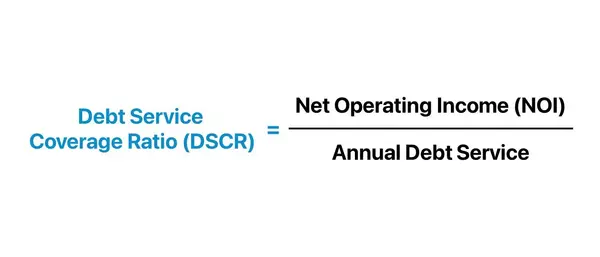

Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

Understanding CMHC MLI Select Terms: DSCR, LTV, NOI, Cap Rate, and More

Navigating the world of multi-unit residential financing can be daunting, especially when dealing with the CMHC MLI Select program. To make informed decisions and maximize your investment returns, it's crucial to understand the

How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide)

How to Buy Multi-Million Dollar Properties with 5% Down: The CMHC MLI Select Program (2025 Guide)

Investing in multi-million dollar properties with just 5% down is no longer a pipe dream—thanks to Canada's CMHC MLI Select Program. Designed for investors eyeing large multi-unit residential buildings,

Navigating the CMHC MLI Select Program: A Step-by-Step Guide for Investors (2025)

Navigating the CMHC MLI Select Program: A Step-by-Step Guide for Investors (2025)

Quick Navigation:

Program Overview

Key Advantages

Eligibility Requirements

Points System Explained

Contact Getty Group:

📱 Instagram: @nasahctus📧 Email: hasan@gettygroup.ca📞 Phone: 403-808-9705

Complete a buyer i

The Ultimate Investor’s Guide to Calgary Rental Properties: Laws, Zoning, and Insights

Ultimate Investor’s Guide to Calgary Rental Properties: Legislation, Compliance, and Insider Tips

Investing in rental properties in Calgary, Alberta, offers unique opportunities for both short-term and long-term rental markets. However, the regulatory landscape can be a maze of municipal bylaws, pr

Real Estate Cash Flow Guide Calgary 2025: Turn $15K Into $600/Month Passive Income

The $1,247 Monthly Real Estate Mistake That's Killing Your Wealth (Real Numbers Inside)

Want to know why most young Calgary investors are bleeding money right now?

They're making ONE crucial mistake that's costing them $14,964 per year.

And it's not what you think.

Looking to compare rental strate

Airbnb vs. Long-Term Rentals: The Ultimate Guide for Calgary Real Estate Investors

Airbnb vs. Long-Term Rentals: Which Strategy Is Right for You?

TL;DR:Short-term rentals (STRs) like Airbnb offer impressive income potential but are harder to finance, operate, and regulate, particularly in Calgary, where new 2025 rules impose stricter compliance standards. Long-term rentals (LTR

What does Bank of Canada's Rate Cuts mean for your Mortgage?

Breaking Down Bank of Canada's Rate Cuts: What It Means for Your Mortgage

Hold onto your wallets, Canadian homeowners and mortgage hunters! The Bank of Canada is making moves that could change your financial landscape. With rate cuts on the horizon and the mortgage market in flux, understanding thes

Market Crash or Opportunity? The Insider's Guide to Surviving Economic Uncertainty

Market Crash or Opportunity? The Insider's Guide to Surviving Economic Uncertainty

BREAKING: Is the stock market heading for a complete meltdown? Before you panic-sell your investments, read this strategic breakdown that could save your financial future—and potentially make you money!

Market Volatil

Why Townhomes Are a Smart Buy

TLDR; Townhomes are the real estate sweet spot in Calgary. They’re affordable, versatile, and appeal to a wide range of buyers—young professionals, families, and retirees.Freehold townhomes save you money on condo fees, while condo-style ones offer killer amenities.

Whether you’re looking for a life

Financing Rental Properties in Calgary | STRs vs. LTRs

Financing Options for Short-Term and Long-Term Rental Properties in Calgary

Introduction

Investing in Calgary’s rental market is an exciting opportunity, but understanding financing requirements is key to success. Whether you’re purchasing a property for short-term rentals (STRs) like Airbnb or lo

Navigating Calgary’s Short-Term Rental Regulations: What Investors Need to Know

Navigating Calgary’s Short-Term Rental Regulations: What Investors Need to Know

Introduction

Calgary’s short-term rental (STR) market offers great opportunities for investors, but strict regulations make it important to know the rules. In this blog, we’ll break down what it takes to run a compliant

Short-Term vs. Long-Term Rentals in Calgary: Which One Wins for ROI?

Short-Term vs. Long-Term Rentals in Calgary: Which One Wins for ROI?

Calgary’s rental market is booming, and if you’re thinking about investing, you’ve got two big options: short-term rentals (like Airbnb) or long-term rentals. Each has its ups and downs, so let’s break it down in a way that’s easy

Hasan Sharif

Phone:+1(403) 808-9705